Introduction to Modern Portfolio Theory

What is Modern Portfolio Theory? Despite the name, ‘Modern’ Portfolio Theory (MPT) was pioneered in 1952 by Nobel Prize-winning economist Harry Markowitz. Almost 70 years later, the principals of MPT remain just as relevant today. The foundation of MPT is based on the logic that the risk and return of a single investment should be analyzed together. An efficient investment portfolio should be based on an analysis of the different investment holdings and their effects on the overall risk and return of the entire portfolio. All too often, investors only focus on the potential returns of their investments. Failing to assess the associated risks is like fielding an NFL offense with a High School defense.

The Basics of MPT

Why is it important to evaluate the impact of each individual holding on the overall risk and returns of the portfolio? It allows investors to create a diversified portfolio of multiple assets focused on maximizing returns at a given level of risk. Investors may also determine the lowest level of risk required to reach a desired level of return and continue to work backward, determining the needed rate of return to retire with a certain level of income*. The return of each investment in the portfolio is less important than the contribution of that investment to the entire portfolio. Unless you want to speculate or gamble, worry less about finding the next Tesla or Amazon and focus more on a well diversified portfolio to reach your long term goals.

How to Calculate Expected Return

Using a model portfolio made up of four assets of equal weights (The average Demand Wealth portfolio has over 12 globally diversified asset classes), we can do a sample calculation for the expected return of the portfolio. Let’s say our four assets are stocks, bonds, real estate, and commodities, each making up 25% of the weight of our portfolio. Now we can look at the expected returns of each asset class multiplied by the weight of each asset to calculate the portfolios expected return. If the expected returns for our stocks is 10%, our returns for the bonds 5%, the returns for our real estate 9%, and our commodities at 6%, then our calculation would look like:

(10% x 25%) + (5% x 25%) + (9% x 25%) + (6% x 25%) = 7.5%

With 7.5% being the expected annual return for the entire portfolio.

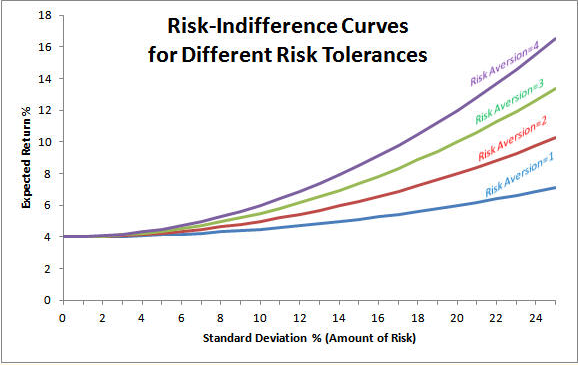

The returns calculation, when charted over the more complicated risk calculation, creates a graph that reveals the most optimal portfolio. The efficient frontier refers to a line drawn through the optimal portfolio at each level of risk. Select a Demand Portfolio of interest and our digital onboarding questionnaire will help you choose the most suitable one.

MPT assumes that investors want to try to mitigate risk as much as possible, therefore they will prefer the least risky portfolio for a desired return. The MPT calculation allows investors to evaluate the best possible returns at each risk level given the weight of each asset in the portfolio and the expected returns of those assets. MPT is all about seeing how various assets can contribute to the overall return of your portfolio at a level of risk that you are comfortable with.

Still, confused? You’re not in this alone! * Schedule a video consultation with a Demand Wealth advisor today and read more about how they utilize MPT here.

This report is a publication of Demand Wealth. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the author as of the date of publication and are subject to change.